09 Dec Government Incentives

If you’re doing a home renovation, you’ll have a lot of money going out the door. Thankfully, the federal government is highly motivated to cut emissions – a significant portion of which come from our homes. So they are helping homeowners to upgrade the energy efficiency of their homes by offering various grants and rebates.

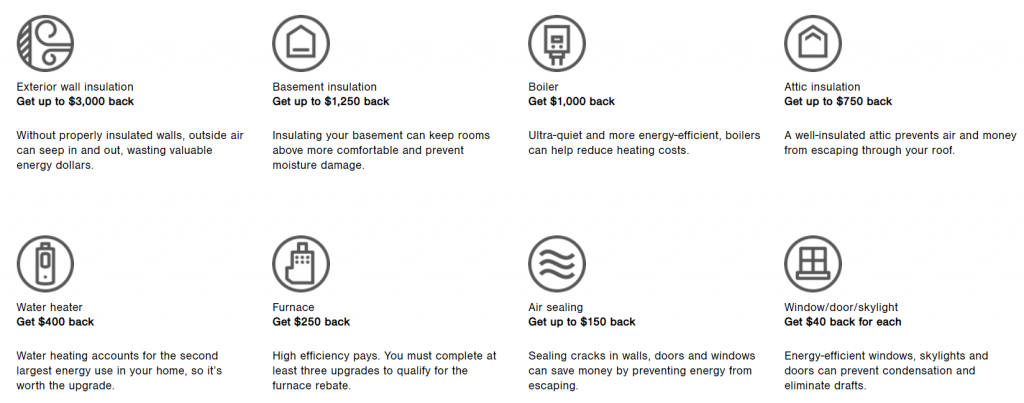

Whether it’s a discount on a smart home thermostat or a rebate on new windows, the incentives come in all shapes and sizes. Below are a few that apply to our specific renovation, but the list is by no means exhaustive. The lesson, at the end of the day, is to do your homework, it can be well worth your time.

If you’re an existing Enbridge customer and you’re investing in one of these options listed, you can get up to $5,000 back on the total value spent. In order to apply for the rebate, you need to get an energy assessment before and after project completion. The assessment will confirm the efficiency improvements and costs roughly $600 (which is reimbursed if the rebate is successful). You may note that the final assessment must be 120 days after the first, but this has been relaxed due to COVID.

If you are not an Enbridge customer, like us, you can apply for this grant, which is essentially the same thing, without the client caveat and a few less restrictions. Where these incentives don’t overlap, there may be an opportunity to apply for both. Best to speak with the EnerGuide energy advisor who does the initial assessment to find out the best course of action.

This is a government incentive offering a rebate on HST if you renovate at least 90% of the habitable area of your owner-occupied home. The definition is strictly defined and you can look at it as either the total rooms or square footage completely removed and replaced – which itself means 4 walls and floors (or ceiling).

Now, this is actually a GST/HST rebate, but it is only applicable for homes with a fair market value of less than $450,000 post-renovation (it was passed in 2005). While you’d be hard-pressed to find a fully renovated home in Ontario for less than $450k, Ontario has a specific HST rebate of up to $16,080 for homes that meet the substantial renovation criteria and there is no minimum home value restriction. A major renovation that drums up $16k in HST, has a little more of a “2021” vibe to it, than a $450k home value.

Other Incentives

It’s worth looking into any other grants or rebates that your municipality, region, or province provide as there are many out there. The government incentives change all the time, often with the most recent budget and political party.

It’s important to note that some proposed incentives may not even come into play, as was the case with a $40,000 interest free loan that was planned in 2021, but never came into fruition. It still may in 2022, but we’ll see.

I would strongly suggest booking an energy assessment from a certified EnerGuide energy advisor before you start the project. It’s a small price to pay, and it will likely be reimbursed. As long as you have the assessment and you keep a record of your expenditures and photos of the progress along the way, give yourself the opportunity to apply for the incentives when the time comes

No Comments